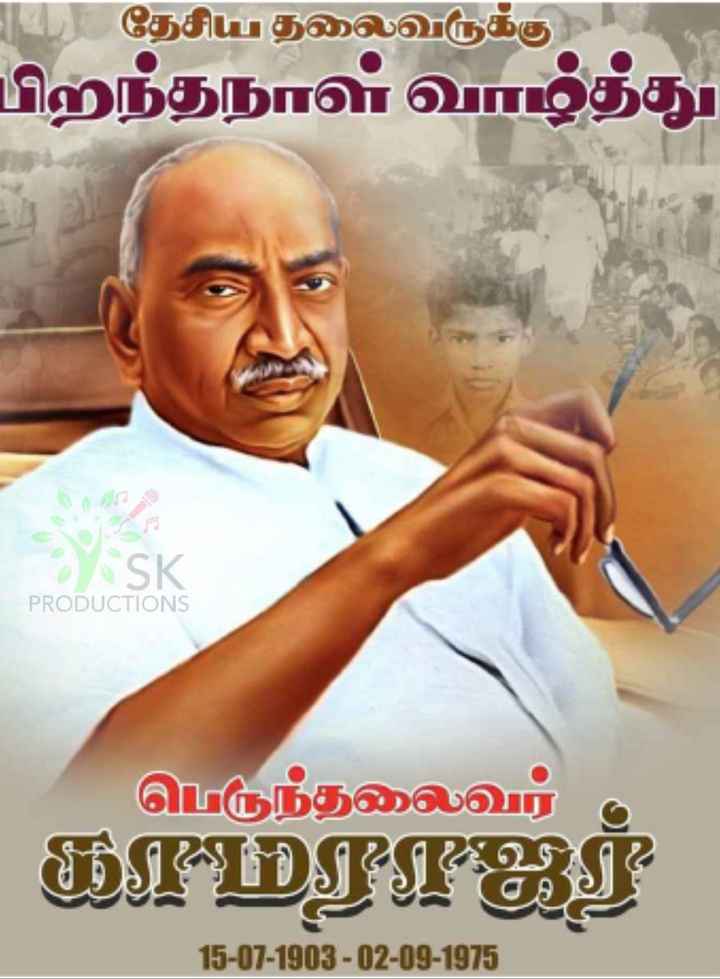

Tamil Soul Monthly - Newspaper

Tamil Soul - Premier News, Culture, and Insights

Explore Tamil Culture with Tamil Soul: Available in Both Tamil and English

Tamil Soul is your premier destination for authentic Tamil news, cultural stories, and in-depth analyses. We bring you the latest updates and insights, celebrating the rich heritage and vibrant life of Tamil Nadu. Stay informed and connected with Tamil Soul.

About - Tamil Soul

Tamil Soul, headquartered in Chennai, is your premier monthly newspaper dedicated to illuminating Tamil culture and current affairs. As a trusted publisher, we deliver comprehensive coverage of local and global news, cultural insights, and community stories. From heritage preservation to contemporary debates, Tamil Soul strives to inform and inspire readers with accurate reporting and engaging content. Join us in exploring the vibrant tapestry of Tamil Nadu’s past, present, and future through our insightful and thought-provoking articles.

Proprietor - Karthikeyan P.

Call Us: +91 94444 01485

- Comprehensive Coverage

- Cultural Insight

- Community Connection

- Quality Journalism

- Engaging Content

- Heritage Preservation

Customer Feedback

Contact

Get In Touch

Contact Information

- Chennai, Tamil Nadu

- tamilsoul2024@gmail.com

-

Proprietor - Karthikeyan P.

+91 94444 01485